bank owned life insurance accounting

Two-thirds of banks in the US. The insured employees have no.

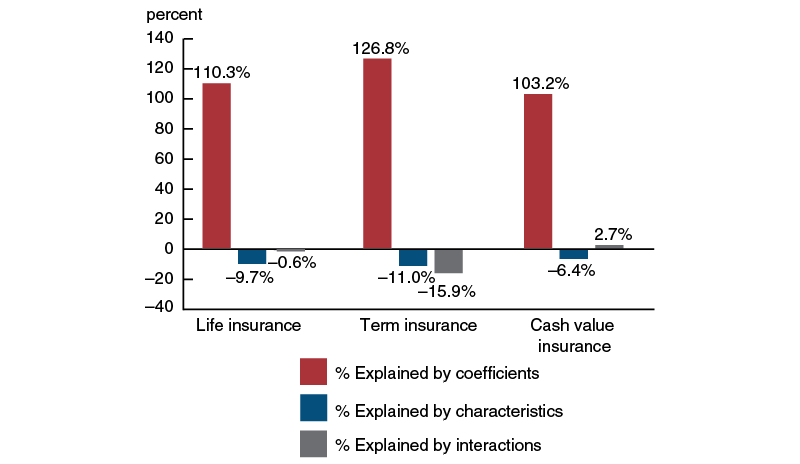

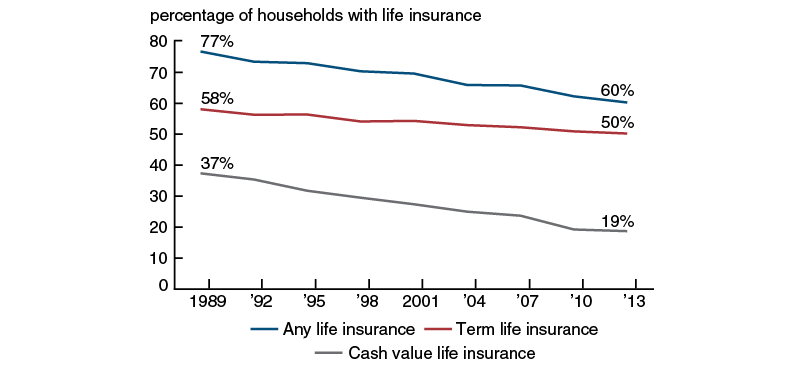

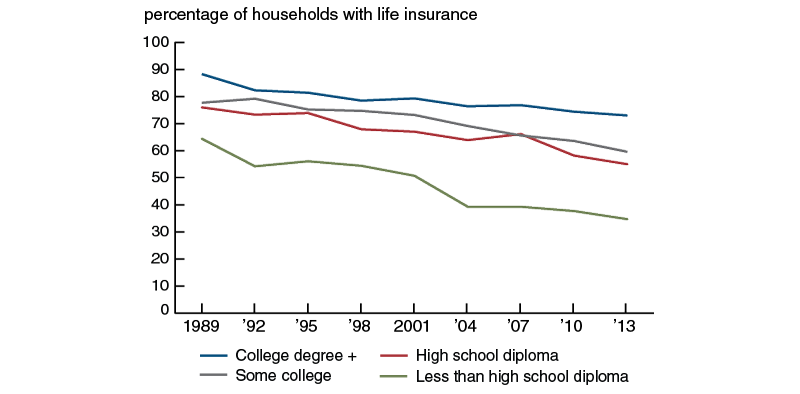

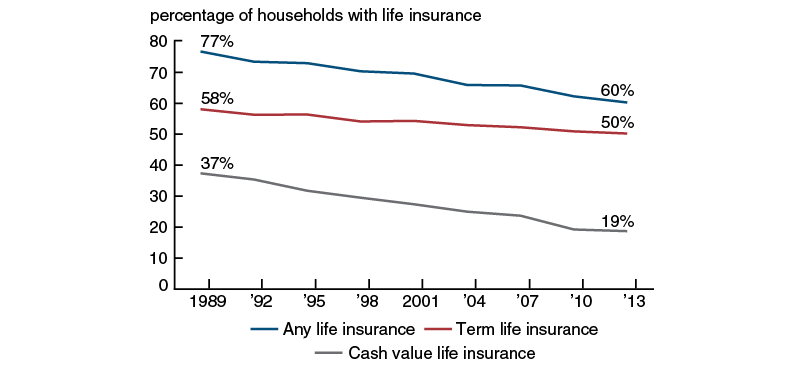

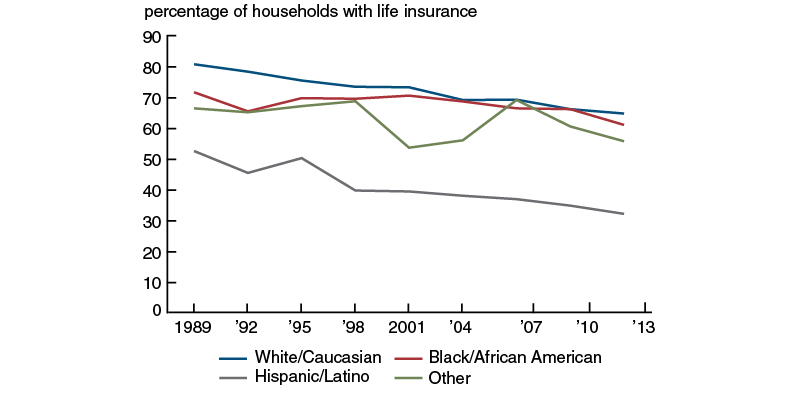

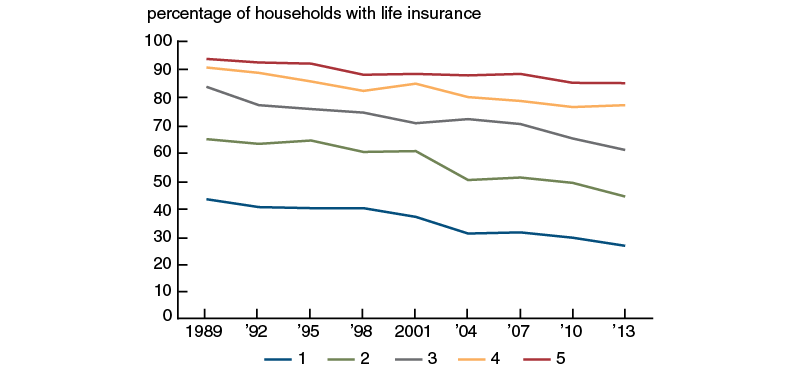

What Explains The Decline In Life Insurance Ownership Federal Reserve Bank Of Chicago

100 online or with a licensed agent.

. Bank Owned Life Insurance BOLI uses tax advantages to create an efficient way to offset employee benefit costs for banks and credit unions. Bank Owned Life Insurance BOLI is a tax efficient method that offsets employee benefit costs. 5000 Life Insurance income account.

Note 10 bank-owned life insurance and imputed income tax reimbursement agreements The Bank has a significant investment in bank-owned life insurance policies BOLI and provides endorsement split dollar life insurance to certain employees in the position of Vice President and higher after one year of service. The general rule for bank-owned life insurance BOLI is that proceeds received by reason of death are tax free. The purchase of bank-owned life insurance BOLI can be.

Bank-owned life insurance BOLI is a form of life insurance used in the banking industry. At purchase a stated maturity value is known which over time may increase to be paid at an undetermined maturity date. Bank-Owned Life Insurance Policies.

While the day-to-day accounting and handling of death benefits received are fairly straight forward for financial reporting and tax purposes an institution on the selling side of an MA transaction with BOLI may face additional tax considerations based on the structure and terms of the sale agreement. Bank-owned life insurance BOLI is a long-duration accrual asset with no stated maturity date yet it has a present and future maturity value. Accounting Reporting the Cash Surrender Value of Bank-Owned Life Insurance Accounting Guidance The Accounting Standards Codification ASC 325-30 provides the guidance to properly account for investments in insurance contracts.

2 Bank-Owned Life Insurance BOLI the premium owns the cash value of the policies and is the beneficiary of the insurance. Purpose The Office of the Comptroller of the Currency OCC the Board of Governors of the Federal Reserve System FRB the Federal Deposit Insurance Corporation FDIC and the Office of Thrift Supervision OTS the agencies are issuing this. The financial institution is the premium payer the owner and the beneficiary of the life insurance policies.

Banks use it as a tax shelter and to fund employee. A financial institution purchases life insurance on a select group of key employees. Many banks now own BOLI bank owned life insurance.

The bank is a direct creditor to the insurance company assets It is likely that the highest rated companies such as MassMutual Northwestern Mutual New York Life etc. Corporate Owned Life Insurance COLI is a well-established concept used by corporations to finance executive benefit liabilities. Bank or acquired for debts previously contracted and may include items such as paid-in stock of a Federal Reserve Bank stock of a Federal Home Loan Bank and stock of a bankers bank.

The life insurance products used in these situations will be bank-owned and technically BOLI. The primary focus however is satisfying the business need. Understanding its impact on the financial statements of your business is an important element in making a decision on the use of a business owned life insurance policy.

Interagency Advisory on Accounting for Deferred Compensation Agreements and Bank-owned Life Insurance. Sometimes a Life Insurance Policy is taken in discharge of a debt from a debtor. The cash surrender value of those policies totals 1822 billion.

BOLI or bank-owned life insurance is just what it sounds like. May give the use of life insurance a financial advantage over other available methods. A bank will purchase and own a life insurance policy on an executive or group of executives lives and the bank is listed as the beneficiary of the policy.

3200 Conclusion The use of Life Insurance may be a key financial decision for your business. Bank interest in bank-owned life insurance BOLI has been surging amid what some describe as a perfect storm of market conditions. Would compare favorable to the best credits in the banks portfolio Misperception of the duration of BOLI.

Or b Whether the said policy is kept alive ie Continuing. The bank purchases and owns an insurance policy on an executives life and is the beneficiary. When properly designed and funded BOLI has the potential to generate income from the growth of the policys cash value and from tax-free insurance proceeds paid to the bank on the death of an insured.

Life Insurance premium expense account. Cash surrender values are allowed to grow tax. HOW DOES IT WORK.

A life insurance policy you can buy to insure the lives of your key employees. A Whether said policy is surrendered to the Insurance Company. Cash surrender values grow tax-deferred providing the bank with monthly bookable income.

However if the BOLI policy is transferred for value ie the purchase of an existing policy rather than a newly issued policy the death benefit is no longer tax free unless an exception applies to the transfer. Bank owned life insurance is a low-maintenance asset that involves. Mirrors the insurance companies fixed income portfolio.

This tax-advantaged asset acts similarly to a bond allowing banks to offset the expenses needed for superior benefits andor informally fund executive benefits. Hold BOLI assets according to the NFP-Michael White BOLI Holdings Report for Q3 2020. Bank owned life insurance accountingPricing is another critical factor because it is much more dynamic than might be the case for retail products.

However in design purpose and structure of the sale will typically supply the name by which. 5000 life insurance income account. Bank-Owned Life Insurance OCC 2004-56 December 2004 This OCC Bulletin provides an overview for the Interagency Statement on the Purchase and Risk Management of Life Insurance which provides general guidance regarding supervisory expectations split-dollar arrangements and the use of life insurance as security for loans.

With the corporate models evolution to Bank Owned Life Insurance or BOLI most of the banking industry has also taken advantage of the positive attributes of life insurance. The Office of the Comptroller of the Currency the Board of Governors of the Federal Reserve System the Federal Deposit Insurance Corporation and the Office of Thrift Supervision have issued the attached interagency statement on bank-owned life insurance BOLI to remind financial institutions that the purchase and risk management of BOLI must be. Refer to the Call Report Instructions for additional details.

BOLI AN INVESTMENT OR LIFE INSURANCE. Accounting treatment in the books of creditor depends on the following two conditions.

What Explains The Decline In Life Insurance Ownership Federal Reserve Bank Of Chicago

Boli Explained Paradigm Life Blog Post

Rule Of Thumb 1 Your Life Insurance Coverage Should Be 8 10 X Of Your Yearly Income If You Are Earn Life Insurance Facts Life Insurance Insurance Marketing

What Explains The Decline In Life Insurance Ownership Federal Reserve Bank Of Chicago

/GettyImages-539244461-88be1a7f24a049229ce2956e0a60d393.jpg)

Corporate Ownership Of Life Insurance Coli Definition

What Explains The Decline In Life Insurance Ownership Federal Reserve Bank Of Chicago

:max_bytes(150000):strip_icc()/lifeinsurance-v32-8e01fd19793a49699e47973cfdf98f3d.png)

Life Insurance Guide To Policies And Companies

/hsbc-branch-in-new-bond-street--london-533780165-ff99ebc393c243cba463ea80559836b0.jpg)

Bank Owned Life Insurance Boli

/insurance-life-protect-help-secure-care-1576403-pxhere.com-015a0a012f484af2bfe5a897031015a2.jpg)

Key Person Insurance Definition

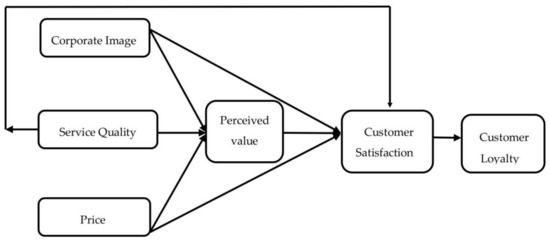

Sustainability Free Full Text Determinants Of Customer Satisfaction And Loyalty In Vietnamese Life Insurance Setting Html

Common Mistakes In Life Insurance Arrangements

What Explains The Decline In Life Insurance Ownership Federal Reserve Bank Of Chicago

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

/dotdash_Final_Subsidiary_Jul_2020-01-5cb00a7e65ed43618112f2f94829fc03.jpg)